Lendhaus was recently awarded Most Innovative Start-Up at the Proptech Awards 2021.

Lendhaus chose PhoenixDX to provide development services and help them deliver their proprietary product set to “disrupt” the commercial real estate finance industry.

Greg Bartlett and Mark Austin, Co-Founders & Joint CEO’s of Lendhaus, have a shared history in financial automation and many years of experience in entrepreneurial companies in finance and technology. They both previously founded another successful FinTech start-up, Cashwerkz. Leon Koutsovasilis, Co-Founder & CTO of Lendhaus, is a digital transformation expert and was CTO at commercial property SaaS pioneer BuildOnline. We have no doubt this will be another successful venture.

“I am thrilled to see the success of Lendhaus and honoured to have worked with these amazing entrepreneurs to help them build this innovative product. I know first-hand the challenges FinTech ventures have to overcome; it’s an exacting sector. I am so pleased we could deliver the right product on time so that Lendhaus could begin supporting their customers and disrupt the commercial real estate lending industry.” – Pedro Carrilho, CEO & Founder of PhoenixDX

We recently spoke to Greg and Mark about building Lendhaus.

Almost every other sector has been “disrupted” in recent years, but this hadn’t happened in the commercial real estate industry. Today, commercial real estate (CRE) financing is a dinosaur. An entirely manual, high friction, complex process that takes 3-9 months to complete.

We could see a gap in the market and knew it was the right time. So, we decided to arm ourselves with industry leaders and strategic thinkers to improve the commercial real estate finance industry and make it easier for all players. As a result, we created Lendhaus, the world’s first managed marketplace for commercial real estate (CRE) financing.

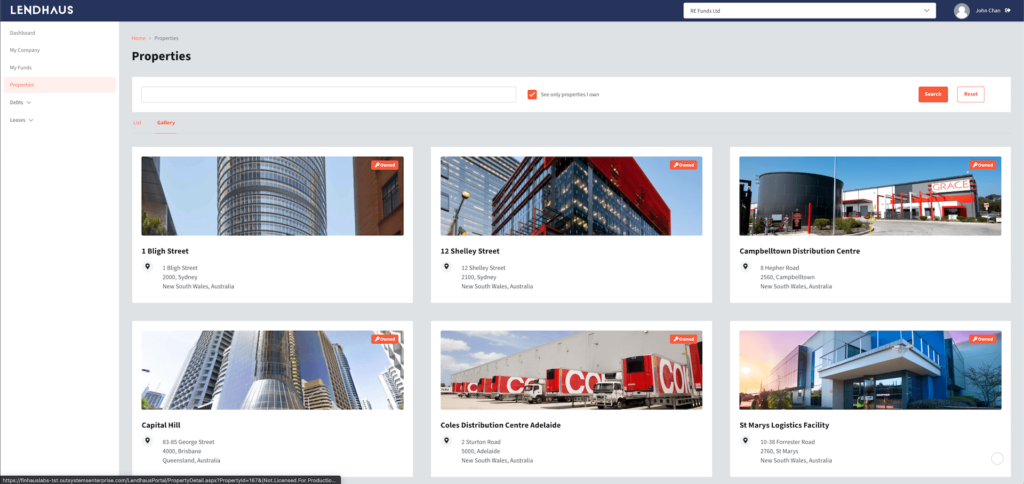

An important component of Lendhaus’s IP was creating a “single source of truth” for our client’s property portfolios. We wanted to fully digitise the loan process so that property managers could store and manage all asset data in a secure yet easily accessible place. We designed Lendhaus to store up-to-date, on-tap data, allowing access to relevant parties, providing a new level of visibility, security and analytics across property portfolios. This seamless, continuously updating approach to data management has been critical to Lendhaus delivering its managed marketplace promise of digitally transforming the end-to-end financing process, even for sophisticated/syndicated/club and multi-property loans. Our end-to-end approach is now under patent.

We got to know OutSystems before starting Lendhaus. When Mark and I co-founded and developed Cashwerkz, another FinTech marketplace system, we met with Paul Rosado, the CEO of OutSystems. We learnt about the speed and cost advantages of using the OutSystems full-stack application platform. We liked OutSystems’ approach, but we had a team of 20+ developers well down the track for that product build, so we couldn’t risk changing technology mid-stream.

However, we didn’t forget our conversation with Paulo Rosado, and 5 years later, when we started to develop Lendhaus, and after carefully reviewing the progress of the OutSystems app platform, we couldn’t justify using a traditional development approach. We wanted to build Lendhaus faster and cheaper, with technology that could evolve with our business and our clients. We also wanted to work with expert and agile teams to deliver and customise our enterprise-grade solution at business pace.

As a team, we wanted to be sure OutSystems could deliver everything we needed for a world-class, managed marketplace platform. We did a lot of research and due diligence. We realised OutSystems’ support for microservices allowed us to incorporate, into the broader Lendhaus platform, any IP we chose to build in other technology (e.g. our real-time pricing engine, AI and machine learning IP) as we needed to. We weren’t locked in. OutSystems was the way forward for us.

When we met Pedro Carrilho, we could see his passion and knowledge for OutSystems and his support of innovative businesses. We had a lot in common, and as they say, birds of a feather flock together.

PhoenixDX in partnership with Do iT Lean formed a very experienced team, with a lot of business knowledge, product development and technical expertise. It would have taken at least a year to build our product with a traditional development approach. Instead, the team delivered our MVP using our prototype in less than three months. It was amazing.

Lendhaus is very simple to set up. A client can get it up and running within two or three days. All documentation and data related to a property and its financing can be entered and accessed by client staff, lawyers, surveyors, assessors etc., with the proper permissions. Documentation is no longer being stored and shared via pen drives or email.

A performance dashboard gives the building owners or managers an overview of performance metrics, allowing them to quickly determine when to refinance a loan or if any documentation needs to be updated. All players are now ready to trade in this global marketplace that allows borrowers, lenders and service providers to choose, negotiate and manage international CRE loans easily. This performance dashboard can also be customised for, and permissioned out to, investors, lenders, valuers and other parties needing access to accurate performance data on an asset or portfolio of assets (e.g. insurers).

We are getting great feedback from customers, and we are making some really exciting deals that we look forward to announcing.

We are deeply honoured to be recognised at the Proptech Awards 2021. We won the Start-Up, Operations and Administration category. We are very proud to be amongst a group of winners that set the bar high. The judge’s statement backed our vision: “A one-stop station for information & execution at this level is very impressive.”

Having travel restricted for the last 18 months due to COVID-19 has focused our efforts in Australia. However, as an executive leadership team, we are already present both in Australia and the UK. We are planning to expand our operational focus to the UK, EU and Canada next, given Lendhaus was designed to be an international marketplace from the get-go. We’re ready for it. Lendhaus has plans for a global presence within 24 months, and we’re aiming to reach a five per cent (5%) market share of CRE financing transactions in 5 years.

Now that the product has been launched and in the market, we are glad that we chose the OutSystems application platform as a foundational element of the Lendhaus platform. We wouldn’t be where we are now if we hadn’t developed the product so quickly. Lendhaus is future-proof, built on a technology made for rapid change and expansion. We are happy that we chose to work with the PhoenixDX team. They partnered with us not only in the execution but also in our vision.

If you want to learn more about Lendhaus, visit their website or reach out to Greg and Mark on LinkedIn.